Everything you need to know about the Franchise agreement

An official contract that binds both the franchisor and the franchisee is...

Everything about Society registration Act 1860

A society is a collection of people who gather together to support...

Procedure for change in the company’s registered office

All business-related communications are conducted at a company’s registered office. A firm...

Procedure for FSSAI License Renewal

Most operators are unaware of the importance of FSSAI License renewal on...

Implications of GST on automobile sectors

“All those cars were once just a dream in somebody’s head” The...

Procedure to obtain ISO 16001 certification

The basic requirements and techniques or procedures for assessing and verifying the...

Indian subsidiary registration process

It’s challenging to set up a subsidiary in India. Your firm must...

Everything you need to know about Design Registration

To assure the shape, highlights, examples, or embellishments, design registration is done....

All about Section 197 and 197a of the Income Tax Act

The Income Tax Act’s Section 197 allows eligible taxpayers to receive TDS...

Section 8 Company Registration Process

When a business is registered as a Non-Profit Organization (NPO), or when...

Mandatory documents required for ISO 9001

Don’t feel overwhelmed by the number of procedures required for ISO registration....

Everything you need to know about patent registration

An invention that simplifies life for everyone can be given to the...

Compliance Check Facility under Sections 206AB and 206CCA

The addition of two new sections, 206AB and 206CCA, to the Income...

Everything about GST Refund Claim

For the registered person who is qualified to make a claim, the...

Tax Benefits available for Small scale industries

New industrial enterprises, including small businesses, are excluded from paying income tax...

All you need to know about professional tax

If you check your pay statement, you’ll see a breakdown of your...

The Basics of Aadhar Card Significance, PAN Linking Process

Aadhaar Card is a 12-digit identifying number that may be verified by...

Impact of GST on Agriculture

India is a country of farmers, and a sizable portion of its...

Benefits of starting a business in India for Foreign entrepreneurs

India being a developing nation has now been considered one of the...

Mistakes to be avoided when filing GST Returns

Despite the fact that the GST laws have been in effect for...

About Section- 50 CA under Income Tax Act

According to section 50C, the sale of a building or piece of...

What is Sin Tax?

Have you ever questioned why your cigarettes or alcoholic beverages are so...

Everything about Statement of financial transaction (SFT)

The Income Tax Act of India has introduced a new concept of...

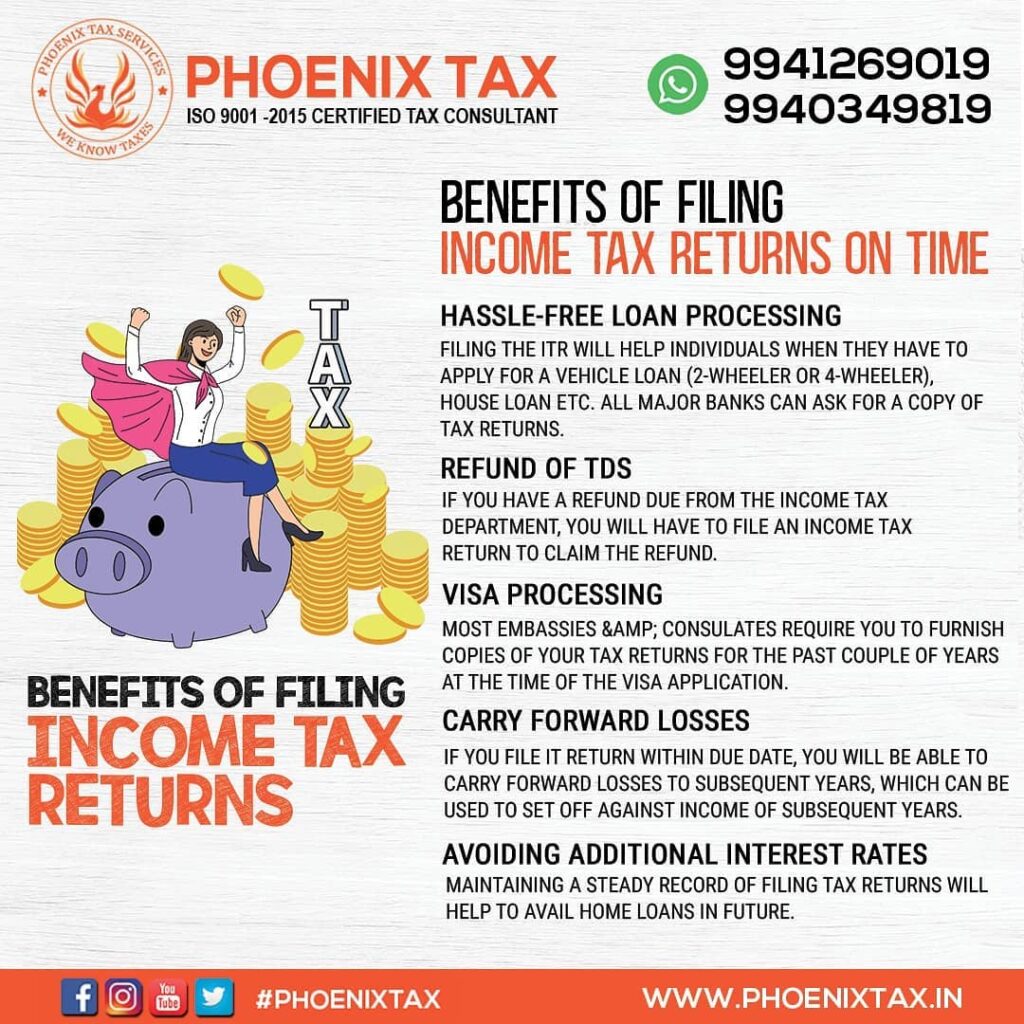

What are the modes of filing Income Tax Return?

According to the Income Tax Rules and Regulations, every person of India...

Benefits of Udyog Aadhar certificate small businesses

Micro, small, and medium enterprises (MSME) play an important part in the...

Everything about E-dispute resolution scheme 2022

The Central Board of Direct Taxes (CBDT) notified the e-Dispute Resolution Scheme,...

Importance of Trademark in Franchise business

Trademarks and franchising go connected at the hip. If you want to...

Step-by-step guide to registering a startup

Are you thinking of starting your own company? Is your entrepreneurial ambition...

Simplified Tax Regime for small Business Corporations

You have a lot to learn as a new business owner. You...

GST Registration for non-resident taxpayers

For non-resident taxable individuals who make taxable supplies in India, GST registration...

List of Goods and services for which ITC is not available

What Is Input Tax Credit and How Does It Work? In the...

Importance of linking Pan with Aadhaar

According to the current rules released by the Income Tax Department, all...

How to set up a new business in Chennai

“The secret of getting ahead is getting started”. Starting up a new...

An easy guide to FORM 10A registration process for trusts /societies

All trusts/societies/institutions/funds/hospitals registered under Section 12A and Section 80G or Section 12AA...

Input Tax credit on Motor vehicle under GST

If you’re a GST-registered individual, you can claim an input tax credit...

Comparison between GSTR-9 and GSTR-9C

Since the publication of the GSTR-9 and GSTR-9C forms by CBIC, there...

Everything you need to know about NPS and how it works

The National Pension System (NPS) is an Indian federal government-sponsored pension and...

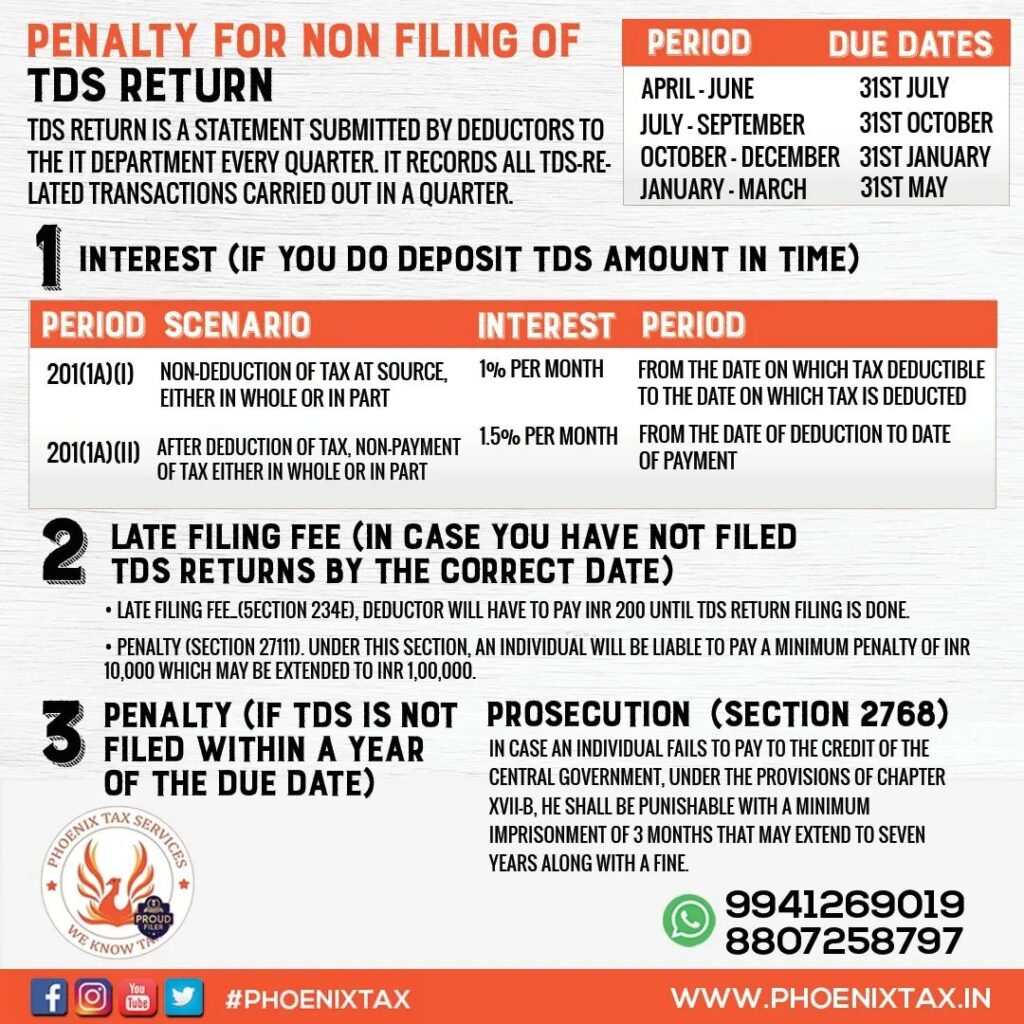

Penalty for Non-filing of TDS returns

TDS stands for Tax Deducted at Source, and it was designed to...

Must-know information on GST for freelancers

Individual freelancers, partnership firms, LLPs, and corporations are all subject to the...

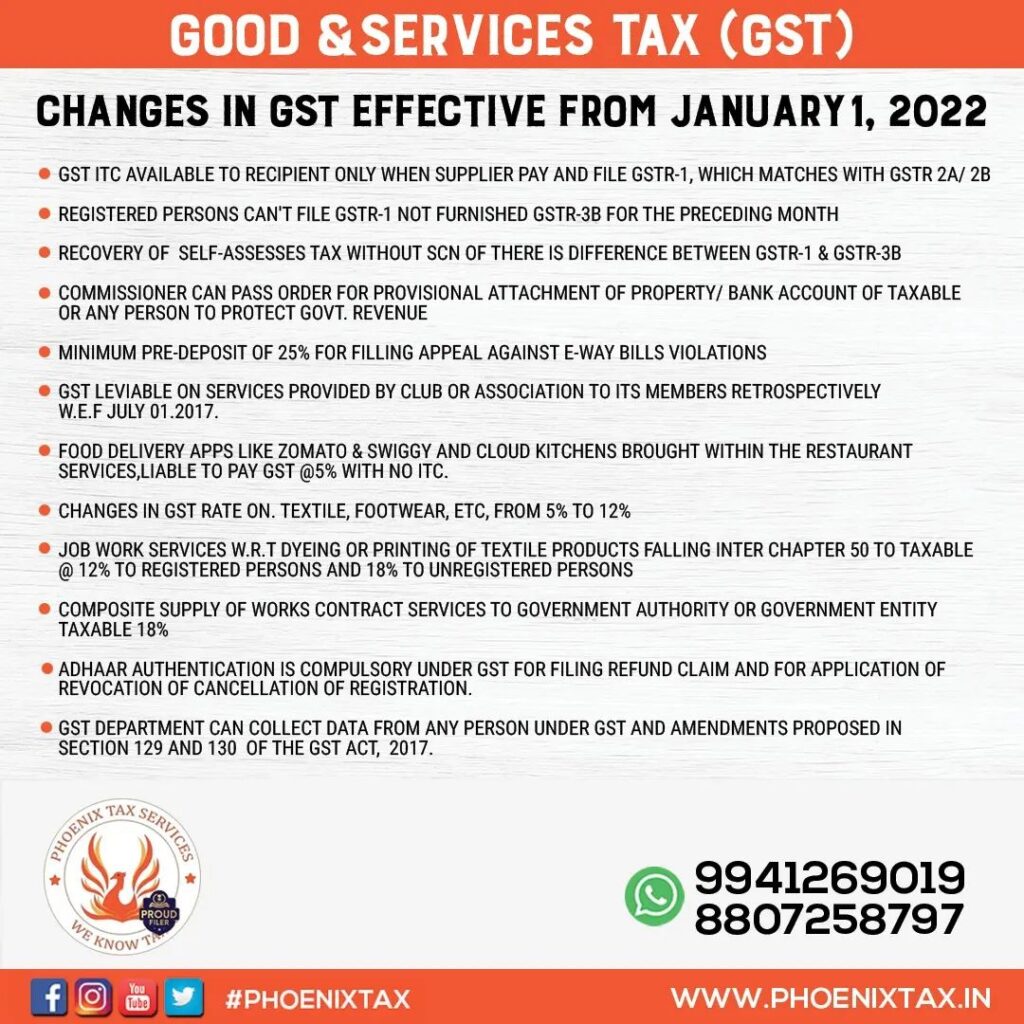

Changes in GST effective from January 1st 2022

The Central Board of Indirect Taxes and Customs (CBIC) has announced a...

Important things every taxpayer must know before filing ITR

There are numerous documents that must be prepared before filing an ITR,...

A few financial mistakes that every entrepreneurs make

Entrepreneurship is not a game for children. The majority of successful business...

How to register your business logo in Chennai?

In the business world, competition is an unavoidable fact. Only by strategically...

Everything you need to know about Section 80EEB

The Union Budget of 2019 was the announcement from the government of...

Why Income Tax is mandatory in India?

As the name implies, income tax is a type of tax collected...

Business registration for NRI’s in India

Incredible NRIs and OCIs alike are flocking to India to build businesses....

Tips to perfect tax planning

Are you worried about paying a significant amount of your income in...

All about Udyam Registration

Micro, Small, and Medium Enterprises are defined as businesses that are engaged...

Complete guide on Income tax liability for minors

As your child approaches maturity, you’ll face a number of key decisions,...

Improvements in GSTR-1

To improve the taxpayer experience, a new and upgraded version of GSTR-1/IFF...

13 ways to save Income tax for salaried employees

Every year, the tax filing season brings with it a slew of...

Everything about GSTR-5 eligibility, due dates, penalty and filing procedure

Under the GST regime, GSTR-5 is a specific return that must be...

3 EASY STEPS TO DOWNLOAD GST REGISTRATION CERTIFICATE

The GST registration certificate is a legal document that serves as a...

EVERYTHING ABOUT TAX DEDUCTION AND TYPES

Tax is not a topic that everybody loves but tax deduction will...

ALL YOU NEED TO KNOW ABOUT INPUT TAX CREDIT UNDER GST

Input Tax Credit could be a mechanism to avoid cascading of taxes. Cascading of...

SECTION 80EE OF THE INCOME TAX ACT

If you are a first time home buyer the Government offers you...

INCOME TAX RERURN FOR SELF-EMPLOYED OR BUSINESS PERSON

Being self-employed is an alluring career possibility. You are employed for yourself...

A COMPLETE DETAIL ON INCOME TAX FOR SALARIED EMPLOYEES

Income tax is the tax you pay on your financial gain. Taxation...

PENALTY FOR NOT FILING INCOME TAX RETURN

What is an Income Tax Return? Income Tax return is a form...

INCOME TAX BASICS EVERY TAXPAYER SHOULD KNOW ABOUT

Paying your Income Tax for the very first time could be a...

Tax benefits for health insurance under section 80D

Life insurance or health insurance has got two benefits to offer to...

A COMPLETE PROCESS OF GSTR-2 FILING IN CHENNAI

Ever since it is introduced in 2017, the Goods and Services Tax,...

A COMPLETE PROCESS OF ITR-1 FILING IN TAMBARAM,CHENNAI

The Indian Income Tax Act, 1961 is a vital piece of general...

A COMPLETE PROCESS OF GSTR-1 FILING IN CHENNAI

What is GSTR-1? A monthly or quarterly return that should be filed...

Trade License registration in Chennai

Is it true that you are hoping to begin another business? Have...

INCOME TAX RETURN IN TAMBARAM,CHENNAI

What is an Income Tax Return? ITR depicts income tax returns. All...

LUT REGISTRATION IN TAMBARAM,CHENNAI

What is the Letter of Undertaking underneath GST? Letter of Undertaking is...

DIN NUMBER REGISTRATION IN CHENNAI

DIN is a unique identification number assigned to any individual meaning to...

Shop and Establishment Act registration in Chennai

The Tamilnadu e-Governance Agency (TNeGA), the state’s nodal agency for digital governance,...

A complete detail on Startup India Policy

Startup India policy The Startup India policy is an initiative of the...

Process of Form-16 filing in Chennai

Form 16 is basically a certificate employers issue to their workers. It...

Process of Income Tax filing in Chennai

What is ITR? ITR depicts Income Tax Return. All the ITR forms...

All about GSTR-3B filing in Chennai

What is GSTR-3B? The GSTR-3B is a consolidated simple summary return that...

A Guide to ESI/EPF Registration in Chennai

ESI is known as for Employee State Insurance controlled by the ESI...

A complete Guide on ISO Certification in Chennai

ISO stands for International Organisation for Standardisation. It is an independent organization...

Process of PAN/TAN registration in Chennai

PAN and TAN both are ten-digit unique alphanumeric numbers issued by the...

A complete guide on IE Code Registration in Chennai

In this age of cut-throat competition, everybody needs to grow their business...

Process of GST Registration in Chennai

GST Registration is a method by which a taxpayer gets himself registered...

A Guide to MSME Registration in Chennai

MSME stands for Micro, Small, and Medium Enterprises, and any enterprise that...

Everything you need to know about Food license registration in Chennai

What is an FSSAI License and Registration? FSSAI is the Food Safety...

Documents required for Company Registration in Chennai

Entrepreneurs in Chennai who are interested in starting a company will want...

Partnership firm registration in Chennai

Individuals who have entered into a partnership with one another to carry...

A beginner’s guide to Digital signature certificate in Chennai

The process with regards to sorting, storage, and retrieval of paper-based documents...

Sole Proprietorship Registration in Chennai

When a company is run and owned by a single person it...

A complete guide to the Trademark Registration Process

What is trademark? Trademark is nothing but a company or business’s logo,...

Guide to Private limited company registration in chennai

A private limited company is a privately held business organization held by...

A guide to e-invoicing for small or medium businesses

While e-invoicing has been mandated for all B2B transactions in corporations with...

A complete guide on the TAN registration process

TAN is the acronym of Tax deduction and Collection Account Number. It...

GST composition scheme for hotels and restaurants

For the little taxpayers to benefit, the GST Department brought out the...

A complete guide on GST Registration in India

The implementation of the products and Services Tax or GST regime in...

12 Steps to beginning a Business in India

Here is a simple guide to assist you register your business in...

20 Ways to save Income Tax in India

People are continually on the lookout for opportunities to save lots of...

Benefits of Registering for GST Composition Scheme

The composition scheme could be a straightforward and simple scheme beneath GST...

New E-way bill laws and regulations from 1st January 2021

WHAT IS E-WAY BILL? E-way bill or Electronic-way bill is a document...

WHY AND HOW CANCELLATION OF GST REGISTRATION IS DONE?

In case you would like to cancel your GST registration as a...

GST Calendar 2021

IMPORTANT GST DATES: GST calendar assists all registered businesses and professionals to...